Current Investment Opportunities

Presents

Property Investment Opportunity

to acquire a

1,025m2 Light Industrial Sectional Title Unit

situated at

Unit 4, Brickworks Industrial Park

42 Brickworks Rd, Briardene Industrial Park, Durban

1. Introduction

At Unity Properties we are passionate about investing in property and it is our vision to grow our privately owned portfolio from its current value of R420m to R1bn within the next five years. It is also our mission to help our clients grow their wealth and passive income earning potential by seeking out good quality property investment assets which will delivery above market returns with minimal risk.

Unity Properties has now been doing this actively for 11 years and having concluded and managed over 60 successful property deals we have evolved into a specialist in this type of investment and the ongoing administration thereof.

In this particular opportunity Unity Properties is facilitating the purchase of Unit 4 Brickworks Industrial Park, a 1,025m2 Light Industrial Warehouse Unit with an existing tenant, Bread Ahead, who will be signing a new five year lease with the new property owners. One of the shareholders in Bread Ahead, who brought us the deal, will be our 30% equity partner. We are therefore looking to find investors to fund the remaining 70% of the equity required.

Unit 4 Brickworks Industrial park is directly adjacent to Unit 5 which a group of Unity Properties’ investors acquired in 2013. The two units being directly next door to each also provides some additional synergies and we are also blessed with previous experience in this particular property.

2. The Investment Objective

The intention of the syndicate will be to acquire and hold the property for a minimum five year investment period. At the end of the first 5 year term and subject to the tenant’s ongoing lease commitments and depending on prevailing market conditions at the time, we will reconsider the most appropriate way forward for the investors. The key point being that you will be required to commit to the investment for at least the first five year period. Having said this if you do need to exit the deal within the five year period Unit Properties will facilitate this for you.

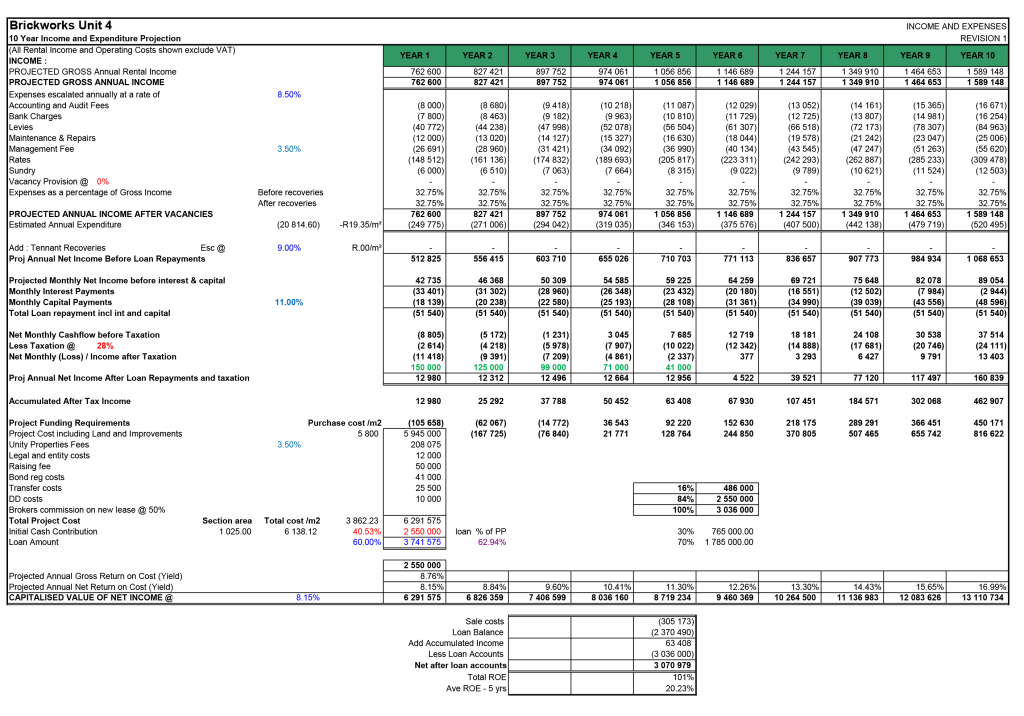

It is estimated that the average annual pretax return on equity at the end of the first 5 years will be in the region of 105% or an average of 21% (pretax) per annum if the property is sold at this time at an 8.15% yield. Our low end scenario would be around 14% per annum and the high end scenario around 25% per annum. Using the IRR method the return will be 16.05%. (I.e. it would be comparable to you investing your money in cash in a bank account at an interest rate of 16.05%).

It should be noted that the performance of the investment will be directly linked to the prevailing yields at the time of the sale and market valuation. These yields are governed by the state of the economy, prevailing interest rates and market supply and demand at the time as well as the quality of the tenant and the location of the property.

3. The Proposed Property

The proposed property is situated in a secure, up market light industrial park called Brickworks Industrial Park consisting of 9 units totaling 15,338m2 of space. Unit 4 is 1,025m2.

Briardene is situated between North Coast Rd and the N2 Highway and is accessed via Nandi Drive providing quick access to the N2 Highway and North Coast Rd.

Briardene is situated next to the very successful Riverhorse Valley Business Estate and is very sought after due to its accessibility and proximity to Riverhorse. The rental rates are also marginally lower than Riverhorse which tenants often find expensive, making it even more popular.

The unit in question is one of nine units in the Park. The Industrial park is currently one of a few such complexes in Briardene and consists of units ranging in sizes from 550m2 to 7500m2.

4. The Building Specifications and fit out

The buildings are finished and fitted out with good quality finishes typical of this type of unit. It has a concrete mezzanine level with office accommodation above. The unit has an above normal electrical amperage supply and it has also been fitted out with expensive capital equipment required to operate the tenant’s business.

5. The Investment structure

The investment vehicle used for the syndicate will be a trust called The Weaver Trust. All investors will be recorded as beneficiaries in the Trust and will be issued with the appropriate documents to prove their beneficiary rights. Gary Gould plus two other investors will be appointed as Trustees of the Trust.

All investor’s cash investments will be recorded as beneficiary loan accounts in the books of the Trust. Maître and Associates will audit the financials annually according to the latest accounting practices. A formal investor loan agreement will be entered into between the Trust and the investors outlining the terms of their loan to the Trust.

Gary Gould of Unity Properties will be the managing member and will be responsible for all administrative aspects of the Trust and its and property. As a Trustee, Gary Gould will be bound by his fiduciary duty to act in the best interests of the Trust and its beneficiaries at all times.

6. Equity Required

This particular deal has been structured to accommodate two types of Investors. The first group being those that will provide the upfront equity payment of R2,550,000 and the other, a group of monthly investors who will contribute monthly to the investment over a five year period.

This structure allows for a lower than normal “break even” equity requirement. To demonstrate, in order to get this investment to break even from day one, we would need to put down R3,65m. Doing it in this particular structure therefore reduces the upfront equity required by R1,1m. This structure improves the return on equity by 8% over five years whilst mitigating risk as we have a predetermined cash flow to fund the cash flow shortfalls. The investment will be specifically structured to have a decreasing monthly shortfall between the income, expenses and bond repayments over a five year period, after which it will then become self- funding.

We are therefore looking for investors to invest multiples of R200,000, R100,000 or R50,000 to fund the initial upfront equity of R2,550,000 (Note 30% or R765,000 of which is covered already) and then 10 Investors to fund the monthly payments as listed in the table below. Each of the 10 Investors will need to fund the initial set up of the trust and other requirements for these investors which will be a further R1,000 each plus VAT. This will need to be paid up front on commitment to the syndicate.

Due to the differing time frames of the equity contributions by the different investors all shareholders loans will attract interest until all the equity has been contributed in year five.

7. The Administrator

All administrative aspects of the property will be handled by Unity Properties property administration division providing investors with a trouble free property investment opportunity. This service arrangement and fee structure will be formalised in a specific property management agreement between the Trust and Unity Properties.

8. Risk Assessment

The risk elements have been broken down and assessed under the following headings:

8.1 Location

Briardene, apart from Riverhorse is undoubtedly one of the better Industrial areas in Durban. Its location and proximity to the N2 ensures that these properties are sought after by tenants. Capital values, whilst slightly below Riverhorse, have also retained their values well through the economic downturn and will no doubt improve substantially when things improve.

8.2 Cash Flow

The investment is structured to be self-funding, with the monthly investors from day one with realistic cash and interest rate buffers in place. The main risks to cash flow being tenant default and a dramatic increase in interest rates over and above what we have already catered for which is unlikely in the short to medium term.

8.3 Interest Rates

The feasibility has been done at 11% interest rate which gives us a buffer of 2% on the rate we should reasonably achieve. We do not foresee interest rates going up more than 2% in the current interest rate upward trending cycle.

8.4 Rental Demand / Vacancy provision

Due to its great logistical position Briardene will remain sought after. Despite the subdued economy there are very few vacancies in Briardene . For this reason we believe it offers a strong level of leasing potential.

8.5 Tenant Default

Bread Ahead the current tenant has agreed to enter into a new five year lease with us at R62/m2 which is market related and the owners will also be taking a 30% share in the investment with us. Visit their Website at www.breadahead.co.za to find out more about them and their business.

8.6 Maintenance Costs

The buildings are now about 5 years old already and maintenance costs will be a reality going forward. The park will be sectional title and there will be a painting requirement to fund within the next 3 – 6 months. I have made a provision for this special levy in the levy budget.

Otherwise the buildings are generally in good condition and are well constructed.

After assessing all of the potential risk factors we believe this risk in this investment to be manageable even in the current market conditions. These will mitigate further as the market improves.

9 Projected 10 year Income Statement

10 Investment Summary

11 Conclusion

Opportunities like this in the current market are few and far between. Before committing to this deal with us Bread Ahead has done extensive research on the rental proposed, the additional power supply, the cost of moving and the benefit of the current location and they have come to the conclusion that the deal presented represents good value for all concerned.

The local light industrial market is still currently the strongest of the three sectors and the location, risk profile and the tenant quality of this opportunity make it a sound investment which will deliver give good returns in the years to come.

Unity Properties now has a successful track record of putting these investment syndicates together and we offer smaller investors an opportunity to invest in quality property assets which normally, due to the relatively high entry levels, are beyond most, smaller individual investors. Syndications also offer you an opportunity to spread your risk over a few investments rather than having all your money tied up in one property. One of the golden rules of investing being that one should not invest more than 10% of ones wealth in any single investment.

Unity Properties specialises in administering these investments after the purchase and we take full responsibility for ensuring your investment in property is a trouble free experience. We believe that the risk in this deal is manageable and if all goes according to plan it will certainly offer good inflation beating returns in excess of 20% per annum over five years.

If you are interested in investing in this syndicate please contact us for further information.

We look forward to being of service to you. If you would like to find out more about Unity Properties please visit our web page on www.unityproperties.co.za or our Face Book page.

Yours faithfully